- July 4, 2022

- Venture Capital

- Comments : 0

How to Recognize When Your Startup Is (or Is Not) Ready to Scale

We’ve all seen the popular TV show in which entrepreneurs pitch their business ideas to a panel of venture capitalists in the hope of securing an investment.

An eager startup delivers their pitch. The audience waits breathlessly for the panel of investors to respond. The winner is announced, and we envision a happy-ever-after

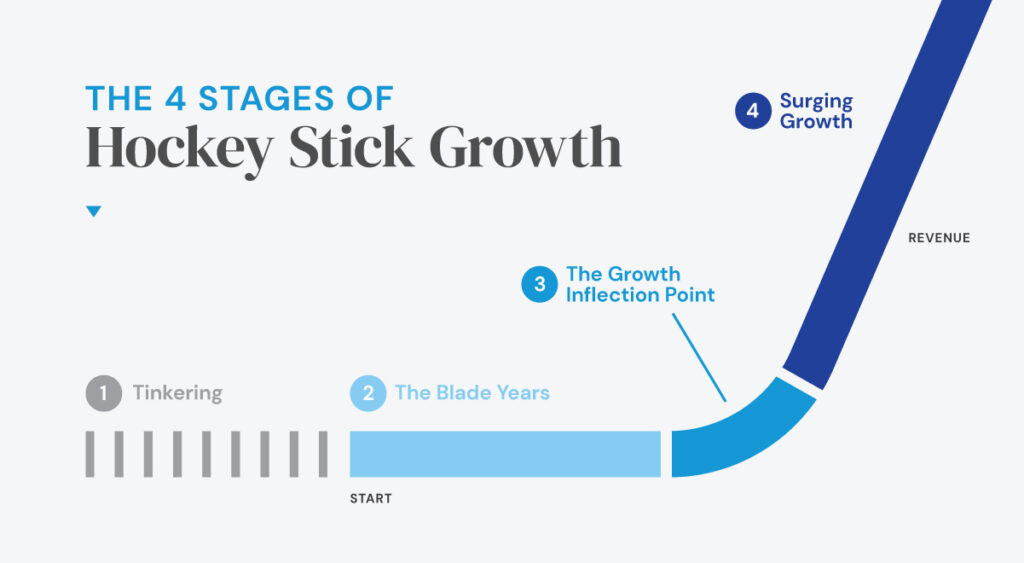

In the popular imagination, the startup’s upward swoosh traces the “hockey-stick curve” of “exponential growth.” Success, we take it, means they’ve scaled—they’ve accelerated the pace of their expansion and are a steadily maturing organization.

This plot line makes for great television. But it’s not always either accurate or advisable.

A startup must be ready to scale. If you rush into scaling too soon, you could endanger not just your startup’s long-term success but also its short-term survival.

So how do you know when your business is ripe for scaling—and when it’s not?

First, you must be able to grasp the difference between growing and scaling. Then you must be able to assess your company’s readiness by examining its current performance with an impartial—and not impatient—eye.

UNDERSTANDING THE DIFFERENCE BETWEEN GROWING AND SCALING

Before coming onboard with NBIF as Senior Investment Manager, I founded Resson, a company in the agriculture tech space. The hands-on experience of running a startup has given me a dual perspective on evaluating new companies and assessing their growth plans.

On the one side, as a former founder, I can relate to the pressure to grow big as quickly as possible. No one launches a startup with conservative dreams. It takes huge ambition (not to mention energy) to get a truly innovative company going.

And in circles where founders hang out, the talk is all about scaling: who’s preparing to scale, who’s just gotten funding to scale, who’s hiring or expanding their production facilities so they get onto that hockeystick growth curve.

On the other side, as an investor, I’m skeptical when I see a company that’s still evolving its business model talking about “scaling up.” To launch a rocket, you need a stable platform. Otherwise, the physics just won’t work.

Normal, incremental growth is the process of building that stable platform. At this stage, your investment in resources is proportional to your growth plans. For example, you want to double your sales, so you hire a second sales rep. Or you want to increase your efficiency in handling orders, so you install an app that will shave minutes off your processing time.

In contrast, scaling means giving your rocket special fuel that will accelerate lift-off. When you’re scaling, any resource you invest in pays off in growth that far exceeds the investment. For example, you decide to fully automate a core business process, and your revenue increases by tenfold. That’s what causes the famous hockey-stick trajectory.

HOW READY ARE YOU TO SCALE?

If you’re still operating with the mantra “test and learn,” then you’re probably still in growth mode. If you’re continually experimenting with product design, pricing, and other aspects of your business model, then you haven’t yet created the solid platform you need for scaling.

Put it this way: if “pivot” is a word that crops up frequently in team meetings, then you have some growing to do before you’re ready to scale.

Another sign indicating growth mode is the absence of revenue. Even if you have promising market research data or letters of intent from potential customers, no revenue means no scaling… for now. You have yet to pass that major milestone of getting people to open their wallets and prove that your product or service is saleable.

WHEN YOU KNOW YOU’RE READY TO SCALE

You’re no longer lining up customer discovery calls by the dozen because you know exactly who your ideal customer is, what they want, and what they’re willing to pay for it.

You know this is true because you have actual paying customers. Your marketing is running smoothly, and so are your production and customer service processes.

As a result, your financial projections are not wishes but reasonable predictions based on past performance.

If you were running an ordinary small business, at this point, you might congratulate yourself on having arrived and take a well-earned vacation. But this is exactly the point at which you may be ready to level up and enter scaling mode.

I say “may be ready” because there’s one last qualification for scaling. How prepared are you to shift from being a visionary leader to leading an established organization?

Frankly, some founders are never ready for this change, and their businesses tend to flounder as a result. If you just can’t picture yourself leaving behind the experimentation of the early days, then you might want to consider bringing on a CEO to guide your company through its scale-up.

HOW TO PERSUADE INVESTORS YOU’RE READY TO SCALE

Scaling almost always requires a fresh influx of capital into the business. Remember, we’re not talking about gradual growth but about ballooning revenue and exploding margins. It’s highly unlikely that you’ll achieve such superlatives without accessing external financial resources.

As an investor, when I’m evaluating a startup’s plans to scale, I want to see that the company has taken much of the risk out of the venture.

I want clear evidence that their product fills a need in the market, and that the market is willing to pay. I don’t want to hear plans for success; To scale I want to see proof of success.

“Traction” isn’t just another buzzword; it’s evidence that you have real customers and a real business. And traction is probably the number one thing it takes to convince an investor to buy into your dreams of scaling.

Investors also look for a few other signs of stability:

- Streamlined work processes. You’ve identified your organization’s core competencies and focus on doing those exceptionally well. You’re obsessive about efficiency, automating or outsourcing any tasks that could distract you from executing on your core functions.

- Savvy hiring. You’ve built a reliable team to drive the company forward. You have a strong but flexible company culture that will support the stress and strain that comes with rapid growth.

- Customer retention. Now that you’ve gained your first customers, you work hard to keep them.

- Successful fundraising. You’ve raised initial amounts of capital from angels seed investors, series A, and maximized government grants and other creative funding options

SO WHERE ARE YOU ON THE JOURNEY TO SCALING?

You can start planning to scale no matter what stage of growth your business is in.

If you have an idea for a company with huge potential, create your startup. Take the first step toward building your rocket platform.

If you’re already growing a business, take a hard look at what you’ve achieved so far. Is your rocket platform ready to support exponential growth?

As you assess your readiness for scaling, make sure you’re making the most of all the available resources and programs that can support your growth. Here in New Brunswick, you have access to so many programs that can help you evolve your business into its next stage.

If you already have a track in the market, a solid team foundation, and growing revenue, you may indeed be ready to scale.

HOW NBIF CAN HELP

- Part of your scaling strategy could be tapping into NBIF funds: To support growth, we have our Startup Investment Fund. You could access up to $200,000 of pre-seed equity investment.

- For scaling companies, we have our Venture Capital Fund. Typically, we invest about $200,000 to $500,000 per round.

Besides offering financial support, we can help connect startups with other resources in the New Brunswick innovation ecosystem. As I know from my own journey as a founder, it takes much more than cash to fuel a breakthrough business. If it takes a village to get a high-potential company started, it takes a network to help it scale.